If your business uses the cash basis method, there’s no need for adjusting entries. At first, you record the cash in December into accounts receivable as profit expected to be received in the future. Then, in February, when the client pays, an adjusting entry needs to be made to record the receivable as cash. Even though you’re paid now, you need to make sure the revenue is recorded in the month you perform the service and actually incur the prepaid expenses. If you use accounting software, you’ll also need to make your own adjusting entries.

Unearned Revenues

When a company purchases supplies, the original order, receiptof the supplies, and receipt of the invoice from the vendor willall trigger journal entries. This trigger does not occur when usingsupplies from the supply closet. Similarly, for unearned revenue,when the company receives an advance payment from the customer forservices yet provided, the cash received will trigger a journalentry. When the company provides the printing services for thecustomer, the customer will not send the company a reminder thatrevenue has now been earned. Situations such as these are whybusinesses need to make adjusting entries.

Accrued Revenues

Expenses should be recognized in the period when the revenues generated by such expenses are recognized. The accrual concept states that income is recognized when earned regardless of when collected and expense is recognized when incurred regardless of when paid. You will learn more about depreciation and its computation inLong-Term Assets.

What is Qualified Business Income?

At the end of the year after analyzing the unearned feesaccount, 40% of the unearned fees have been earned. When a company purchases supplies, it may not use all suppliesimmediately, but chances are the company has used some of thesupplies by the end of the period. It is not worth it to recordevery time someone uses a pencil or piece of paper during theperiod, so at the end of the period, this account needs to beupdated for the value of what has been used.

- The bookkeeper or accountant must ensure that the adjustment is recorded correctly as a debit or credit to the appropriate account, depending on the nature of the adjustment.

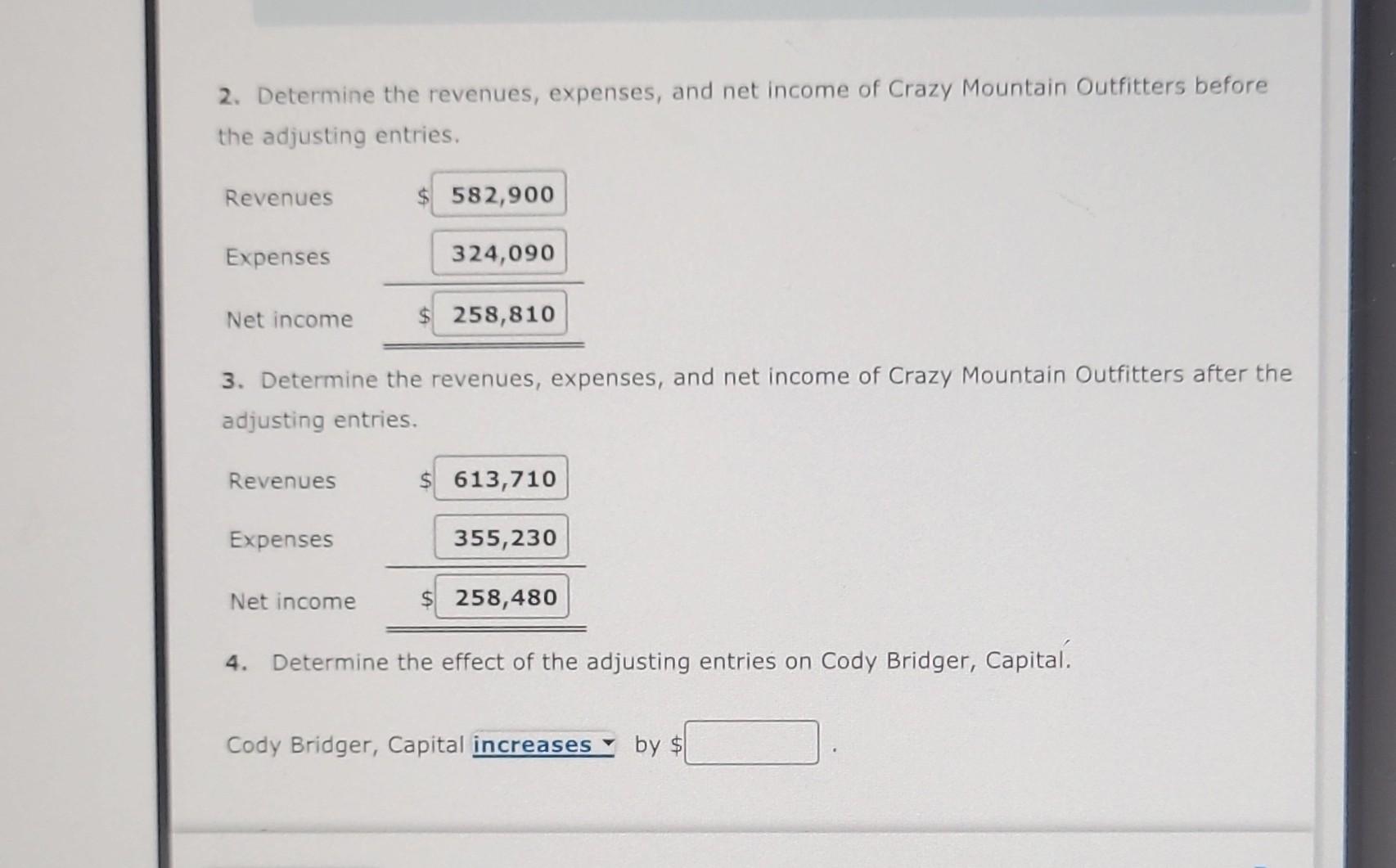

- The main purpose of adjusting entries is to update the accounts to conform with the accrual concept.

- — Paul’s employee works half a pay period, so Paul accrues $500 of wages.

- The most common method used to adjust non-cash expenses in business is depreciation.

- They then pay you in January or February – after the previous accounting period has finished.

- Then, in March, when you deliver your talk and actually earn the fee, move the money from deferred revenue to consulting revenue.

Examples of Adjusting Entries

To record the allowance for doubtful accounts, an adjusting entry is made to increase the allowance for doubtful accounts expense account and decrease the corresponding asset account. In the balance sheet, adjustment entries are used to update the values of assets and liabilities. For example, if a company has an account receivable that is unlikely to be collected, an adjustment entry is made to reduce the value of the asset.

Your Financial Statements At The End Of The Accounting Period May Be Inaccurate

The magic happens when our intuitive software and real, human support come together. Book a demo today to see what running your business is like with Bench. — Paul’s employee works half a pay period, so Paul accrues $500 of wages.

The two specific types of adjustments are accruedrevenues and accrued expenses. In practice, you are more likely to encounter deferrals than accruals in your small business. The most common deferrals are prepaid expenses and unearned revenues.

Depreciation may also require an adjustment at the end of theperiod. Recall that depreciation isthe systematic method to record the allocation of cost over a givenperiod of certain assets. This allocation of cost is recorded overthe useful life of the asset, or the time periodover which an asset cost is allocated. The allocated cost up tothat point is recorded in Accumulated seek bromance Depreciation, a contra assetaccount. A contra account is an account pairedwith another account type, has an opposite normal balance to thepaired account, and reduces the balance in the paired account atthe end of a period. The required adjusting entries depend on what types oftransactions the company has, but there are some common types ofadjusting entries.