There are a few other guidelines that support the need foradjusting entries. One difference is the supplies account; the figure on paper doesnot match the value of the supplies inventory still available.Another difference was interest earned from his bank account. Our partners cannot pay us to guarantee favorable reviews of their products or services. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Accounting Periods

Under the cash method of accounting, a business records an expense when it pays a bill and revenue when it receives cash. The problem is, the inflow and outflow of cash doesn’t always line up with the actual revenue and expense. Say, for example, a client prepays you for six months’ worth of work.

When to make adjustments in accounting

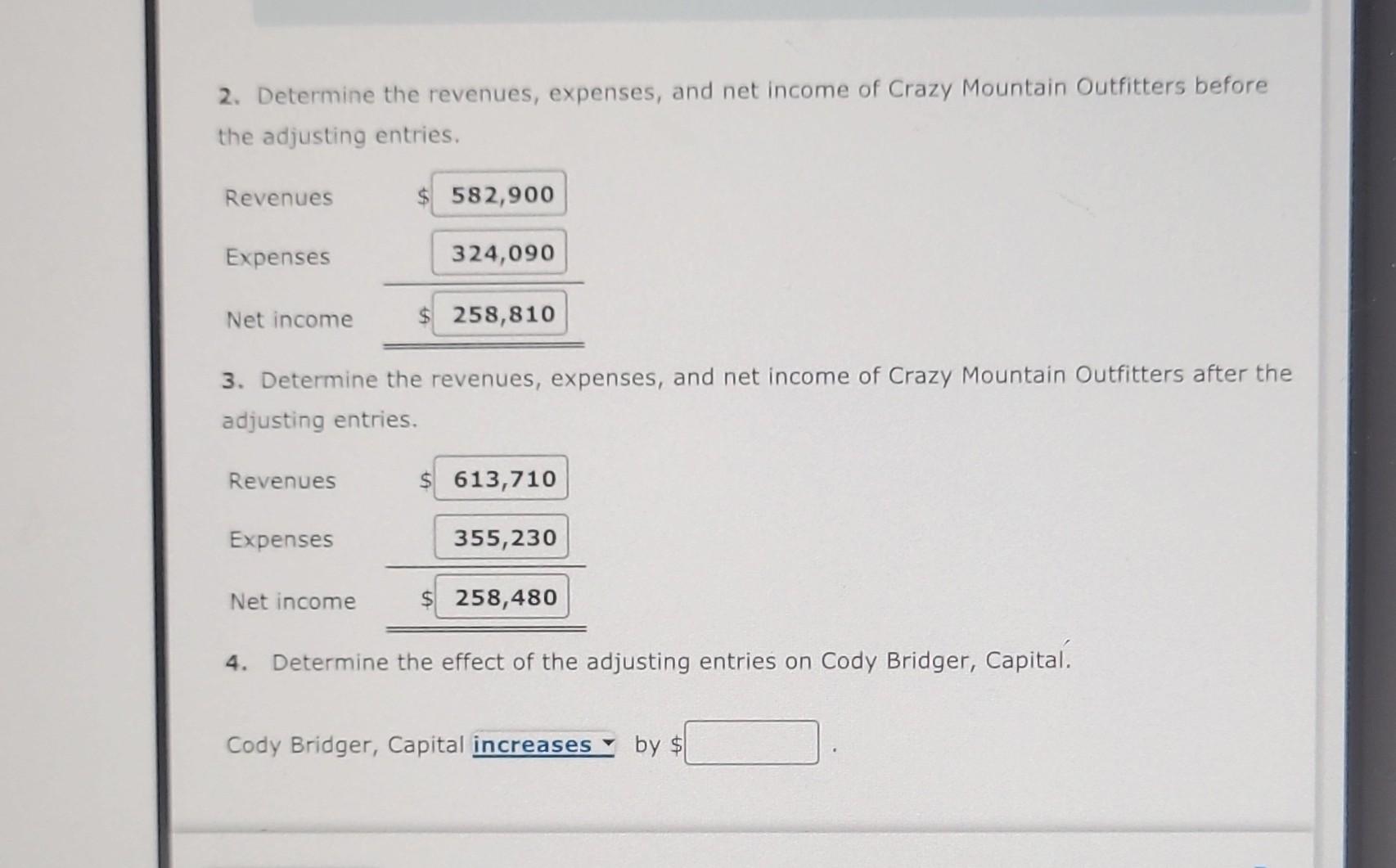

Similarly, if a company has incurred an expense that has not yet been recognized, an adjustment entry is made to include this expense in the income statement. Adjustment entries are an important part of the accounting period and the accounting cycle. The accounting period is the period of time for which financial statements are prepared, usually one year. The accounting cycle is the process of recording, classifying, and summarizing financial transactions for a given accounting period. Insurance Expense, Wages Expense, Advertising Expense, Interest Expense are expenses matched with the period of time in the heading of the income statement. Under the accrual basis of accounting, the matching is NOT based on the date that the expenses are paid.

Introduction to adjusting entries Purpose, types, and composition

The Inventory Loss account could either be a sub-account of cost of goods sold, or you could list it as an operating expense. We prefer to see it as an operating expense so it doesn’t skew your gross profit margin. The Reserve for Inventory Loss account is a contra asset account, and it shows up under your Inventory asset account on your balance sheet as a negative number. Using the business insurance example, you paid $1,200 for next year’s coverage on Dec. 17 of the previous year. If you are a cash basis taxpayer, this payment would reduce your taxable income for the previous year by $1,200.

( . Adjusting entries for accruing uncollected revenue:

The software streamlines the process a bit, compared to using spreadsheets. But you’re still 100% on the line for making sure those adjusting entries are accurate and completed on time. In the accounting cycle, adjusting entries are made prior to preparing a trial balance and generating financial statements.

Examples of Adjusting Entries

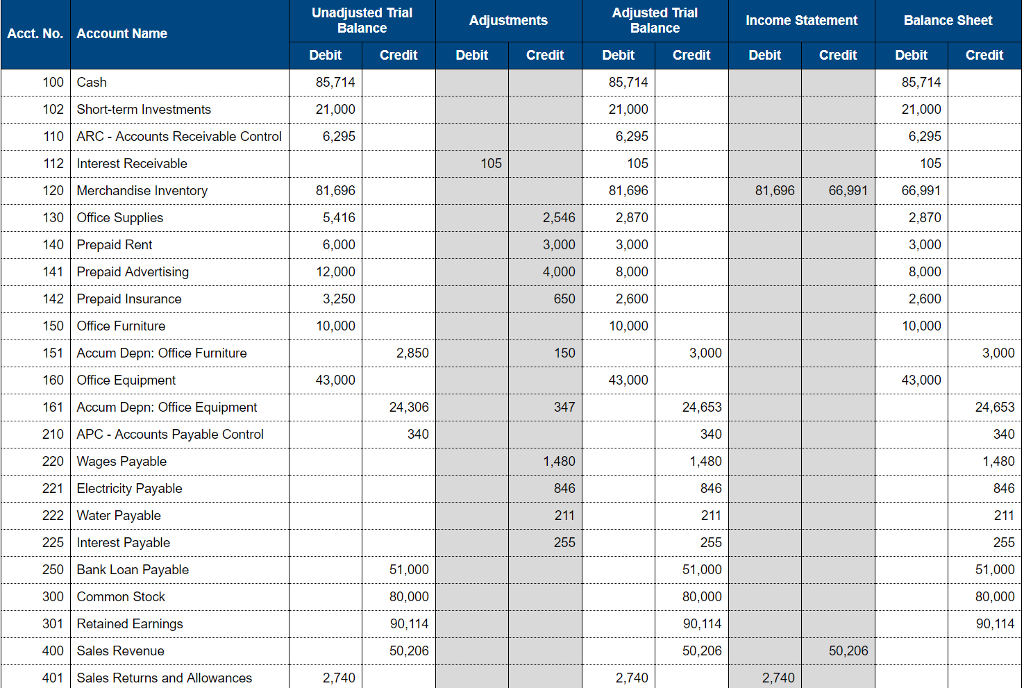

However, in practice, the Trial Balance does not provide true and complete financial information because some transactions must be adjusted to arrive at the true profit. You rent a new space for your tote manufacturing business, and decide to pre-pay a year’s worth of rent in December. First, during February, when you produce the bags and invoice the client, you record the anticipated income. Adjusting entries will play different roles in your life depending on which type of bookkeeping system you have in place. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions.

Taxes the company owes during a periodthat are unpaid require adjustment at the end of a period. Accrued expenses are expenses incurred in aperiod but have yet to be recorded, and no money has been paid.Some examples include interest, tax, and salary expenses. Interest can be earned from bank account holdings, notesreceivable, and some accounts receivables (depending on thecontract).

To learn more about the balance sheet, see our Balance Sheet Outline. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. We at Deskera offer an intuitive, easy-to-use accounting software you can principles of sound tax policy access from any device with an internet connection. Other methods that non-cash expenses can be adjusted through include amortization, depletion, stock-based compensation, etc. If the Final Accounts are prepared without considering these items, the trading results (i.e., gross profit and net profit) will be incorrect.

- Each entry consists of a debit and a credit, and is recorded in accordance with the double-entry accounting system.

- Then when the client sends payment in December, it’s time to make the adjusting entry.

- Note that this interest has not been paid at the end of theperiod, only earned.

- Each month that passes, the company needs to record rentused for the month.

- Specifically, they make sure that the numbers you have recorded match up to the correct accounting periods.

For example, a service providing company may receive service fees from its clients for more than one period, or it may pay some of its expenses for many periods in advance. All revenues received or all expenses paid in advance cannot be reported on the income statement for the current accounting period. They must be assigned to the relevant accounting periods and reported on the relevant income statements. Prepaid expenses or unearned revenues – Prepaid expenses are goods or services that have been paid for by a company but have not been consumed yet. This means the company pays for the insurance but doesn’t actually get the full benefit of the insurance contract until the end of the six-month period. This transaction is recorded as a prepayment until the expenses are incurred.